Allstate car insurance is a crucial aspect of responsible vehicle ownership, providing protection against unforeseen accidents and liabilities. Allstate Car Insurance Company, a player that is prominent in the insurance coverage industry, provides many Auto insurance products to satisfy the unique needs of drivers.

In this article, we shall explore Allstate’s car insurance coverage offerings, its advantages, and what sets it independent of the competition.

Allstate Car Insurance Products:

Allstate offers a suite that is comprehensive of insurance policy options tailored to meet the diverse requirements of drivers:

- Liability Coverage:

- Allstate’s liability coverage helps economically protect you if you are in charge of an accident.

- It meets state needs for minimum coverage and can be customized to suit your needs.

- This coverage pays for the expenses being medical property damage of the other party in an accident you caused.

- Collision Coverage:

- Collision coverage takes care of injury to your car caused by a collision with another car or item.

- It’s especially valuable when you yourself have a newer car or one with a higher value.

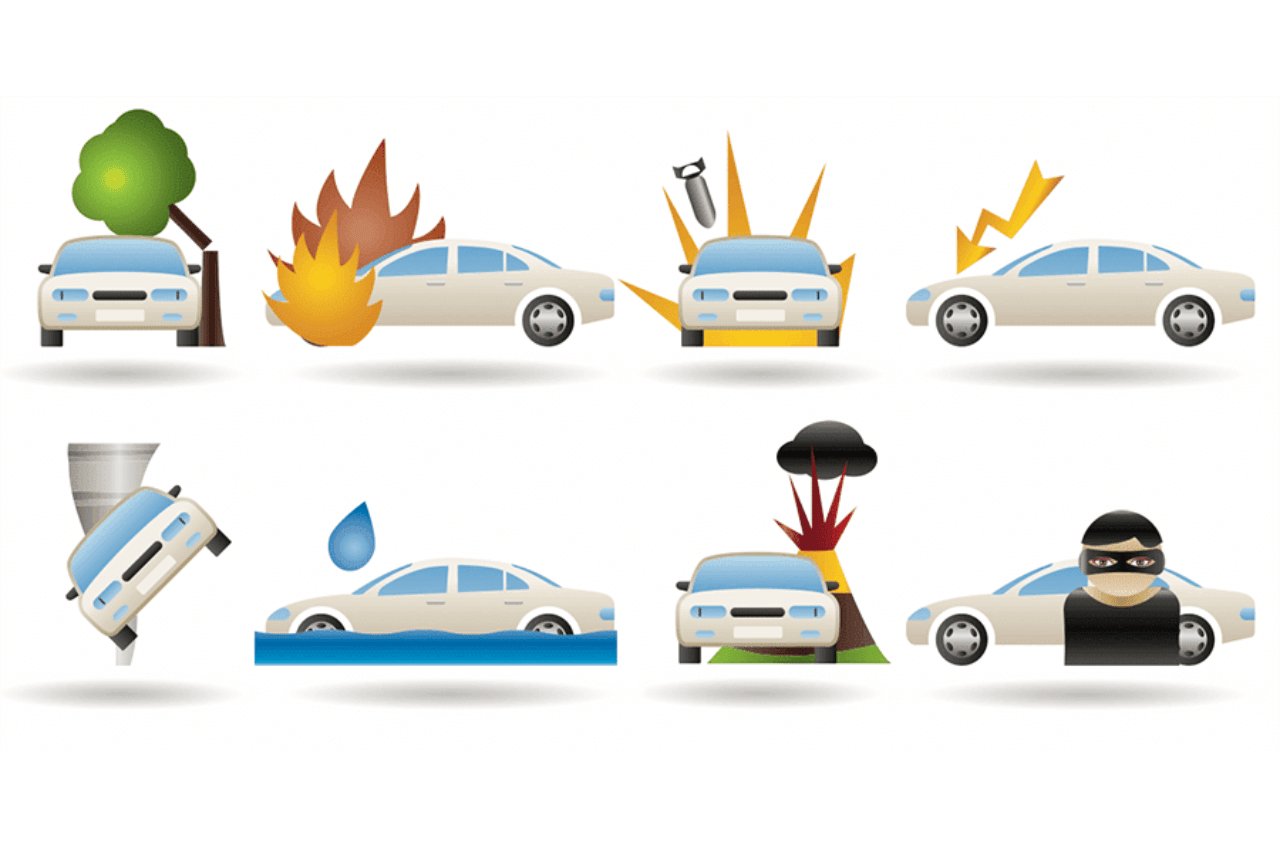

- Comprehensive Coverage:

- Comprehensive protection protects your car or truck from non-collision incidents like theft, vandalism, fire, or disasters that are natural.

- It provides peace of mind in situations away from control.

- Uninsured/Underinsured Motorist Coverage:

- This coverage safeguards you just in case you’re taking it. part in a major accident having a motorist who does not have insurance coverage or has coverage that is insufficient.

- It ensures that the costs that are medical automobile repairs are covered.

Benefits of Allstate Car Insurance:

Allstate doesn’t just provide protection; it provides several benefits Being unique make it be noticed:

- Safe rewards that are driving Discounts:

- Allstate rewards drivers that are safe discounts and reduced premiums.

- Programs like “Safe Driving Bonus” can save cash with time.

- Claim Satisfaction Guarantee:

- Allstate’s claim satisfaction guarantee promises claims that are smooth.

- In the event that you’re not content with your claims experience, you can receive a premium credit that is six-month.

- Digital Tools and Mobile App Features:

- Allstate’s user-friendly app allows mobile policyholders to handle their accounts, file claims, and even access roadside support.

- it gives convenience and accessibility.

- Availability of Local Agents:

- Allstate’s network of neighbourhood agents ensures you have personalized support and can reach out for assistance or guidance.

Allstate’s Drivewise Program:

Allstate’s Drivewise program utilizes telematics technology to observe your driving practices and potentially lower your insurance rates based on your own safe behaviour that is driving. By participating in Drivewise, policyholders can receive feedback that is valuable and enjoy savings.

Cost Factors and Pricing:

The cost of Allstate vehicle insurance coverage depends on several factors, including:

- Driving Record:

- A driving that is clean typically results in lower premiums.

- Accidents and traffic violations can lead to raised rates.

- Vehicle Type and Age:

- The make, model, and age of your car affect insurance rates.

- Newer or even more automobiles that are expensive need higher coverage.

- Location:

- At Allstate car insurance Your geographical location plays a role in determining your rates.

- Urban areas frequently have higher prices due to increased traffic and theft risk.

Allstate Basic Car Insurance

The fee of Allstate’s fundamental car insurance policies can vary widely depending on factors such as your location, driving history, the kind of protection you choose, and the deductible you select.

It’s necessary to request a quote that is personalized for Allstate car insurance or one. of their agents to find out the specific price of basic car insurance that meets your needs.

Allstate Insurance for High-Risk Drivers

Allstate, like many other insurance companies, offers insurance options for high-risk drivers. High-risk motorists are individuals who might have a history of accidents, traffic violations, DUI convictions, or other factors that make them statistically almost certainly going to be engaged in accidents and file claims.

Insurance for high-risk drivers typically comes at a higher premium expense due to the likelihood that is increased.

Here are some of your options and factors for high-risk drivers with Allstate car insurance:

- High-Risk Auto Insurance: Allstate may offer a car that is high-risk policies particularly made for drivers with a history of accidents or violations. These policies often come with higher premiums to offset the increased risk.

2.SR-22 Insurance: If you have had a driving that is serious, such as a DUI or a suspended license, you may have to obtain an SR-22 form, also known as a certificate of economic responsibility. Allstate can provide insurance that is SR-22 to meet these legal requirements.

- Accident Forgiveness: Allstate Wasilla, like other insurers, offers an Accident Forgiveness program, which makes it possible for policyholders to prevent rate increases after their at-fault that is first accident. This can be good for high-risk drivers who are worried about premium hikes.

Discounts & Further Info

- Discounts: Allstate car insurance may still make discounts available to drivers who are high-risk might help lower their premiums. These discounts might include a driver that is safe, multi-policy discounts, or discounts for completing defensive driving courses.

- Usage-Based Insurance: Allstate offers a program called Drivewise, which tracks your driving behaviour using an app that is a mobile device set up in your vehicle. If you are a driver who is at high risk of boosting your driving habits, playing Drivewise and demonstrating safe driving behaviour can lead to discounts on your premiums.

- Shop Around: It’s needed for high-risk drivers to compare insurance quotes from multiple providers to find probably the most rates that are competitive. Various insurers have different underwriting guidelines and prices, so shopping around is important.

Retain in the brain that the availability of these options and the specific terms and conditions can vary by state and circumstances that are individual.

If you are a motorist that is high-risk it’s really a good idea to contact Allstate or an Allstate representative directly to talk about your alternatives and get an individualized quote based on your unique situation.

Additionally, start thinking about working on improving your driving record with time, as maintaining an archive that is clean help you qualify for reduced insurance costs in the near future.

Allstate Car Insurance for New Drivers/TeenDrivers

Allstate, like many other insurance companies, provides insurance choices tailored to drivers which can be new. Insurance for new motorists, especially young and people who are inexperienced can be costly because they’ve been statistically almost certainly going to be concerned in accidents.

However, Allstate provides several options and factors to greatly help new motorists find the coverage they need at a price that is reasonable

- Insurance that is usage-based Allstate’s Drivewise program, which tracks driving behaviour through a mobile app or device installed into the vehicle, can be a choice for new drivers. They might be eligible for discounts on their premiums should they demonstrate safe driving practices.

- Steer Clear Program: This system is made for inexperienced motorists or individuals with a limited history of driving. It includes academic materials and safe directions for driving. Completing the Steer Clear program might lead to discounts.

- Multi-Policy Discounts: New drivers who bundle other insurance coverage policies for their auto insurance, such as home or renters insurance, may be qualified to receive multi-policy discounts.

For New Teen Drivers

- Parent-Teen Driving Agreement: Allstate provides resources and guidance for moms dads and guardians to create a Parent-Teen Driving Agreement, which can help establish safe driving guidelines and objectives for young drivers.

- TeenSMART Program: Allstate supplies a program called TeenSMART, which is designed to help young drivers (typically ages 16-21) become safer and more drivers that are responsible. Completing this scheduled system may lead to discounts on auto insurance premiums.

- Student that is good: Allstate car insurance often provides discounts for high school or college students who maintain good grades. To be eligible for a discount, students typically need to keep a GPA that is certain or in the honour roll.

- Parental Guidance: Parents of new drivers can consult with Allstate agents to look for the protection options that are best and make sure their kid is adequately protected while on the road.

- Coverage Options: Allstate offers a range of coverage options that can be customized to match the requirements of brand-new motorists. These options can sometimes include liability coverage, collision coverage, comprehensive coverage, and motorist protection that is uninsured/underinsured.

It’s crucial for new drivers and their moms and dads or guardians to carefully review their insurance coverage options, consider their circumstances being individuals and discuss coverage requirements. with an Allstate car insurance representative or insurance professional.

Doing your research and quotes that compare multiple insurers can also help new drivers find the best rates and coverage options for their specific situation.

Allstate car insurance offers a business plan for commercial cars utilized in the course of company operations. Business Allstate car insurance, also called commercial auto insurance, is created to provide protection for vehicles that are mainly used for business purposes.

Allstate Business Car Insurance:

- Liability Coverage: Like personal automobile insurance, business auto insurance includes liability coverage, which helps pay for physical damage and property damage costs if you or one of your employees are at fault in an accident while utilizing an ongoing business car.

- Collision Coverage: This coverage helps pay for the cost of repairing or replacing your vehicle that is commercial if damaged in a collision with another automobile or item.

- Comprehensive Coverage: Comprehensive coverage helps protect against non-collision-related harm to your commercial vehicle, particularly damage from theft, vandalism, fire, or climate that is severe.

- Uninsured/Underinsured Motorist Coverage: This protection assists you if you’re in an accident having a motorist who does not have insurance coverage or has coverage that is insufficient.

- Medical Payment Coverage: Medical payment coverage can help pay medical costs for you and your people in the case of an accident, no matter who is at fault.

-

More Features

- Cargo Coverage: In case your business involves goods that are transporting equipment, Allstate may offer cargo protection to guard the worthiness associated with items you’re carrying in your commercial vehicle.

- Rental Reimbursement: This coverage that is optional helps protect the price of a rental vehicle while your commercial vehicle is being repaired after a major accident.

- Towing and Labor: This coverage is optional help spent for crisis roadside help and towing services for commercial vehicles.

- Hired and auto that is non-Owned: In case the employees use their personal automobiles for business purposes or you hire vehicles for your company operations, this coverage can protect you in case of accidents involving those vehicles.

- Customized Coverage: Allstate car insurance typically provides coverage that is customized to tailor your policy to your specific business needs.

When a business is considering insurance from Allstate or any other provider, it’s essential to accurately assess your organization. insurance requirements, including the types of automobiles you utilize, how these are typically used, and the level of coverage required.

Allstate car insurance can work with you to definitely determine the coverage that is acceptable and provide a quote centred on your unique business circumstances.

It is advisable to consult with an Allstate agent or insurance expert to discuss your business which is certain auto needs and get an insurance plan that suits your needs.

Allstate Car Insurance Claim Process

The process for filing an auto insurance claim with Allstate typically involves steps. Listed here is a summary of how the Allstate automobile insurance claim process works:

- Safety and Reporting: First of all, make certain that everyone mixed up in the accident is safe. If there are injuries, contact emergency services immediately. As soon as security is assured, report the accident to your police and obtain the content of the police report, if possible.

- Exchange Information: Exchange contact, insurance, and automobile information with the other events mixed up in an accident. Make sure to collect names, addresses, phone numbers, license plate numbers, and insurance policy details.

- Contact Allstate: Contact Allstate as soon as feasible to report the accident and initiate the claims process. This can be done through their internet site, mobile app, or by calling the Allstate claims department. Be prepared to supply your policy number, details about the accident, and any information that is relevant.

- Claims Adjuster Assignment: Allstate will assign a claims adjuster to your situation. The adjuster will review the information you provided and may even schedule an inspection of your vehicle if necessary.

- Vehicle Inspection: If required, the claims adjuster will inspect your vehicle to assess the extent of the estimate and damage repair costs. They may also coordinate with repair stores or recommend preferred repair facilities.

- Estimate and Settlement: In line with the inspection, the adjuster provides you with an estimate for the cost of repairs or the actual cash value (ACV) of your automobile if it’s deemed a loss that is total. Allstate will continue to work with you to settle the claim, which may involve issuing a check to cover repairs or the ACV of one’s car.

Additional Information

- Repairs: If your car or truck is repairable, a repair can be chosen by your shop. Allstate may have chosen repair stores in your town that provide assured workmanship. You’ll additionally choose your repair that is own facility.

- Providing a Leasing Automobile: If your policy includes rental vehicle coverage, Allstate might provide you with a leasing automobile while your vehicle is being repaired.

- Claim Resolution: Once repairs are completed or a settlement is reached, you’ll use Allstate to finalize the claim and any paperwork that is necessary. This could include signing a release form if funds are accepted by you.

- Payment: If you are entitled to a payment, Allstate car insurance will issue a search for the agreed-upon amount. This can cover repair expenses, medical expenses (if applicable), along with other qualified expenses related to the accident.

- Follow-Up: After the claim is fixed, it’s essential to follow up with Allstate if you encounter any pressing issues or have additional questions concerning the claim procedure.

Remember that the particular details of the claim process can vary based on the circumstances of the accident, your policy, along your location. Always review your insurance contract and policy with Allstate Car Insurance directly for step-by-step guidance on what direction to go with your specific claim.

Furthermore, it’s essential to report accidents promptly and supply accurate information that is complete to facilitate a smooth claims process.

Allstate Collision Coverage Benefits

Collision coverage can be a component that is important of auto insurance coverage, and Allstate, like a great many other insurance agencies, provides collision protection as part of its policies.

Collision protection provides benefits and protection that are economic if your vehicle is damaged as a direct result of a collision. with another vehicle or item, irrespective of who reaches fault. Right here are the key benefits of Allstate collision protection:

- Coverage for Repairs: Allstate collision coverage helps spend the fee of restoring your vehicle when it is damaged in a collision. This can include repairs to your car or truck’s human body, framework, or components that are mechanical including the engine or transmission.

- Vehicle Replacement: If the cost of restoring your automobile surpasses its cash that is actual value, Allstate may offer money to supersede your vehicle with an identical one. The ACV is the marketplace value of the automobile during the right period of the accident, taking into account factors like age, mileage, and condition.

- Deductible: When you file a collision claim with Allstate, you will end up accountable for having to pay a deductible. This is the quantity that is out-of-pocket consent to pay for before your insurance coverage kicks in. It is possible to choose the amount that is deductible when your policy and higher deductibles typically lead to lower premium expenses.

Further Benefits

- Flexibility: Allstate car insurance provides flexibility in choosing where to have your car or truck repaired. You need to use one of the recommended fix shops or select your repair that is advised facility. However, utilizing a shop that is preferred offers benefits such as for example fully guaranteed workmanship and a streamlined claims process.

- Rental Car Coverage: With a leasing car while your vehicle is being fixed or replaced if you have rental car protection as part of your policy or as an optional add-on, Allstate may provide you. This may help you maintain mobility and continue with your activities that are daily.

- Accident Forgiveness: Some Allstate policies include Accident Forgiveness, which means that your rates won’t automatically increase after your at-fault that is very first accident. This can help you avoid higher premiums because of a collision claim.

- Customization: Allstate allows you to personalize your collision protection limits and deductibles considering your preferences and spending plan. You’ll work with an Allstate agent to tailor your policy to meet your needs which are specific.

It’s important to note that collision coverage is usually optional, but it can be beneficial, particularly when you’ve got a newer or more car that is valuable.

It helps protect your interests that are economic covering the price of repairing or replacing your. car after a collision, reducing the out-of-pocket expenses you would otherwise incur.

When the collision is considered, make sure you review your policy details, including deductibles and protection limits, and discuss your certain needs with an Allstate agent to make certain you have the appropriate amount of protection for your vehicle.

How Much Is Allstate Car Insurance Full Coverage Cost Per Month?

The expense of Allstate motor insurance per month can vary widely depending on several factors, as well as your location, the kind of coverage you choose, your age, your history that is driving make and model of the car, along with other individual factors.

There is no answer that is one-size-fits-all the question of just how much Allstate car insurance coverage will cost per month because insurance costs are highly individualized.

To get an estimate that is accurate of how much Allstate auto insurance will cost per month, you ought to do the annotated following:

- Request a Quote: Contact Allstate or visit their website to request a motor insurance quote that is personalized. You will have to provide information that is specific to yourself, your vehicle, as well as your coverage preferences.

- Provide Accurate Information: Make certain that the given information you offer is accurate and up-to-date. Any mistakes or omissions can impact the accuracy of one’s quote.

- Choose Coverage Options: Allstate car insurance offers coverage that is various, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and optional add-ons like rental car reimbursement and roadside assistance. The coverage choices you choose will significantly impact your premium.

More Coverage Cost

- Select Deductibles: You’ll likewise be required to choose deductibles for your protection. Higher deductibles typically result in lower premiums, but you will pay more away from your pocket in the event of a claim.

- Give consideration to Discounts: Allstate offers different discounts, such as safe driver discounts, good student discounts, multi-policy discounts, and more. Be certain to ask about discounts that may apply to you.

- Review Payment Frequency: insurance coverage premiums can be compensated, semi-annually, or annually. The payment frequency you choose can affect the cost that is total.

- Compare Quotes: It’s a practice that is good to obtain quotes from multiple insurance coverage providers to compare rates and protection choices. This can help you discover the value that is perfect for your specific needs.

Remember that Allstate car insurance rates can vary significantly from one person to another, even for similar coverage. Factors such as your location and history that is driving a significant role in determining your premium.

Furthermore, insurance prices can alter in the long run due to different factors in the insurance coverage industry and your needs which are individual.

To get the most estimate that is accurate of month-to-month car insurance premiums from Allstate, exciting to reach away to them directly or use their online quoting tool, providing all the necessary factual statements about your situation.

Allstate Car Insurance Customer Service Phone Number

This is a telephone number for Allstate Car Insurance. You are able to contact us 24/7 at 800-726-6033.

How to Get Allstate Car Insurance Quote?

A “quote” refers to an estimate of the price or premium a policyholder would pay for the specific insurance plan in the context of insurance coverage. Insurance coverage organizations provide quotes centred on different factors, including the type and quantity of coverage, the policyholder’s risk profile, and other details that are relevant.

Quotes allow individuals and organizations to comprehend the cost that is potential of before purchasing a policy, helping them make informed choices about their insurance needs.

For Allstate car insurance Quotes and Car Insurance quotes Comparison see the Link just below.

Allstate Local Agents for Car Insurance.

Local insurance agents act as intermediaries between insurance companies and policyholders. They sell policies, provide guidance, personalize coverage, assist with claims, and offer customer help that is ongoing. Their role is vital in helping customers navigate insurance complexities and ensure they have actually the coverage that is right their needs.

Conclusion

Allstate car insurance offers a comprehensive range of coverage options and advantages to guarantee you need on the road that you have security. A user-friendly mobile app, and local agents willing to assist you, Allstate goes the extra mile to provide peace of mind for motorists with safe driving rewards.

When it comes to safeguarding your automobile and funds, Allstate is just an option that is trusted by the insurance industry. Consider trying to an Allstate agent to talk about your particular requirements and acquire an auto insurance estimate today that is personalized. Drive confidently knowing that you have actually Allstate with you. I have covered a lot on Allstate Car Insurance. if you were seeking in the topic “Is Allstate a Good Car Insurance Company” we think. Don’t hesitate to ask about Allstate car insurance.